Home

About Us

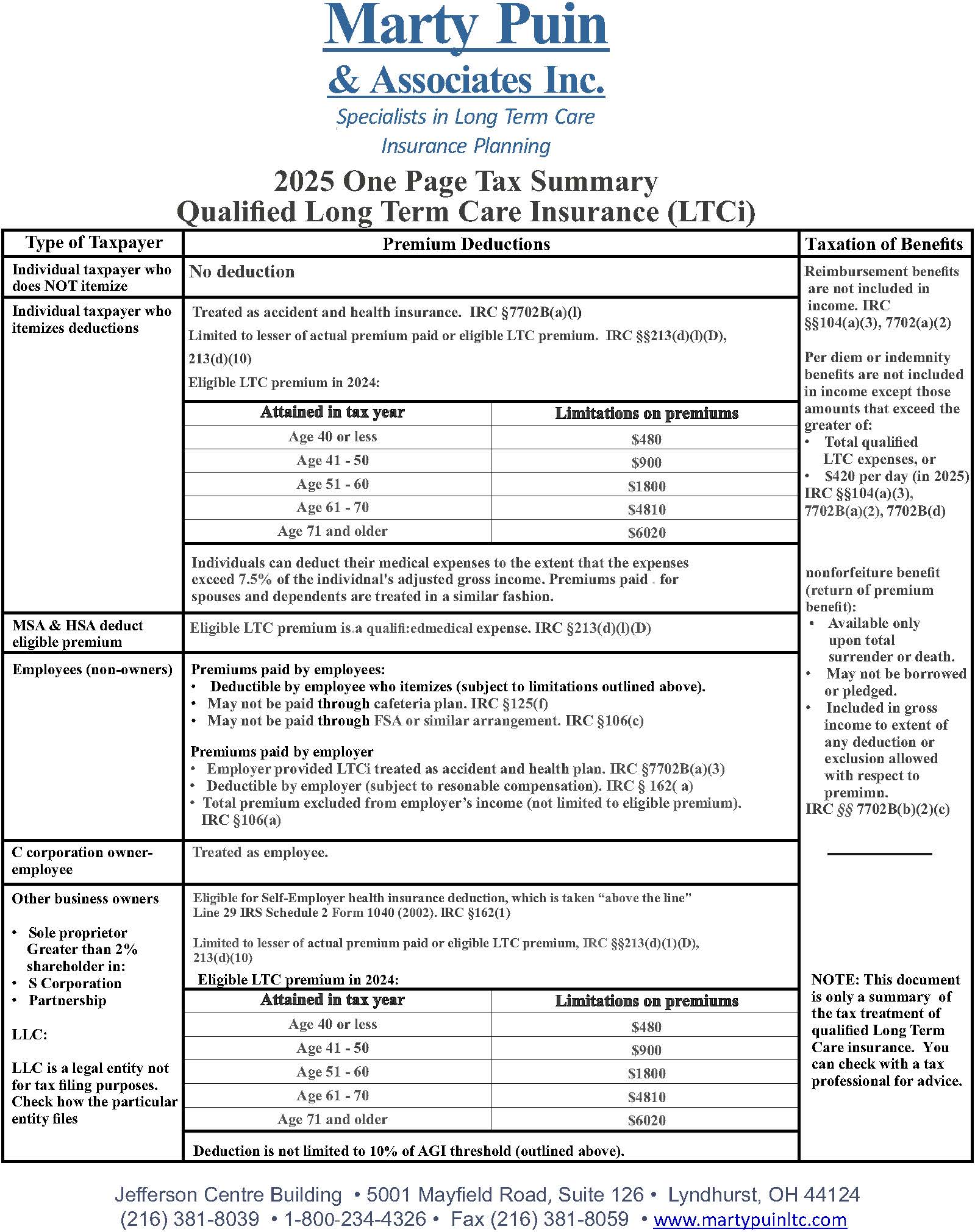

LTCi Tax Treatment

LTC Information

Contact Us

Do your financial or retirement plans include protection

against Long Term Care expenses?

If you are like most people, you have insured your health, your car, your life, and your home. You have probably worked hard to accumulate assets for your retirement years. But what if you needed Long Term Care? Long Term Care is a risk that can impact or even derail all of your carefully thought out plans. The time to start planning is now.

This Web site is a resource that can help you take your first step toward protecting your future. You will not only receive a thorough education about issues relating to Long Term Care, but some specifics about Long Term Care insurance as well. Simply click on any of the sections listed. This will take you to its explanation and in most cases, subsections across the top for further explanations.

Our Mission Statement

Our mission is to educate and protect Americans from the devastating costs of Long Term Care. Families do not realize how important Long Term Care planning is until they are uninsurable or actually need help with Activities of Daily Living. We don't want that to happen to you!

Our agency specializes in Long Term Care insurance and we offer the most affordable and comprehensive plans in the market place for individuals, associations, or employer groups. We can assist you in designing the proper plan for you and your family.

About Martin Puin

Martin B. Puin is President of Marty Puin & Associates Inc. an insurance agency that specializes in the sales and marketing of Long Term Care insurance (LTCi). Marty has appeared regularly on WKYC TV-3 in Cleveland discussing Long Term Care and the importance of Planning for it. He has contributed to stories about LTC that have been published in the Cleveland Plain Dealer, the Columbus Dispatch, the Lake County News Herald, Cleveland Crains Business and the Youngstown Vindicator. Marty has also written articles about LTCi for Brokers World Magazine, The Ohio Underwriters Magazine and Life Selling Magazine. He is on the board of Advisors of the American Association of Long Term Care insurance, a national panel that helps develops standards of professionalism for the industry.

Mr. Puin has testified before the Ohio Legislature on the need to provide tax incentives for Ohio citizens who purchase Long Term Care insurance. He holds the industry designation CLTC-Certified in Long Term Care. Marty teaches a continuing education class on LTCi to Ohio insurance agents and is an Ohio Partnership trainer. He has taught legal continuing education to Ohio attorneys, CPA’s, nurses and social workers.

Marty Puin & Associates is the agency of record for Long Term Care insurance sales for AAA Auto Clubs in Ohio. In past years Prudential and Met Life have partnered with Marty to help their agents and brokers understand and market Long Term Care insurance . He has given over 600 career presentations on the topic of Long Term Care to various groups where he always mentions his father Nick, a WWII Marine Veteran who was in a nursing home for many years before he died in 2010.

A graduate of the University of Dayton, Marty lives in Lyndhurst Ohio where he served on the City Council for 26 years.

|

Click Text to open links, click text again to retract

Note: The underlined links will take you to a third-party site

-

Types of LTC

Types of Long Term Care

Long Term Care can be received in a variety of settings. The setting is usually determined by the support system (your family, attending physician, or someone qualified to develop a plan of care) you have and the reason that you need Long Term Care. Some needs can easily be taken care of at home, while others would be better cared for in a nursing home.

Skilled nursing facilities are usually comprised of two separate components. The first component is a unit that provides skilled nursing care that may be covered by Medicare (if the care meets the criteria that Medicare sets forth). The rest of the facility provides non-skilled (or custodial) care. The goal of the “Medicare” section of the skilled nursing facility is to provide services needed to rehabilitate the patient so they can return home. However, many times patients are unable to return home and are moved over to the non-skilled or custodial section of the facility. Usually in these cases the patient may not have any support services or family in the community that would allow them to leave the facility.

Example:

Mary Ann had a stroke a year ago. Immediately after her stroke she was admitted to a skilled nursing facility in the Medicare section and received rehabilitative therapy on a daily basis. After about 45 days, her therapists determined that she was not getting better and would need help with her activities of daily living for the rest of her life. Because she did not have anyone to take care of her at home, she was transferred to the non-skilled wing of the skilled nursing facility where she will live from now on.

Home care is generally considered appropriate at the custodial and non-skilled care levels. Skilled care can be provided in the home, however it can be very expensive. Home care could consist of a weekly visit by a homemaker who performs housekeeping chores, a personal care attendant that provides assistance with bathing and dressing, or it may be a daily visit by a home health registered nurse or therapist.

Example:

Verna was diagnosed with Parkinson’s disease two years ago. Now she is unable to walk without assistance. She cannot bathe or dress herself. Her daughter, Shirley, is currently helping her with these needs. Her daughter has to go back to work in order to save money for her two children who will be going to college in the next two years. Verna is now going to have to tap into her life savings and pay for a caregiver to come in and help her, so that she can stay at home.

Assisted-care living facilities,otherwise known as assisted living facilities (or ALF’s), may also be referred to as residential care facilities for the elderly (In California, they are referred to as Residential Care Facilities). These facilities provide non-skilled care for people who need help with their Activities of Daily Living but can also provide a lot of their own care and get through a daily routine with minimal assistance. Usually, skilled care is not provided in assisted living facilities.

These facilities are an excellent alternative to a nursing home. The residents may live in individual apartments that they can furnish and personalize to make it seem more like home. Meals are usually provided in a community dining room and there are lots of activities and social events to attend. You can find these facilities as part of a larger independent retirement community, or as a stand alone facility that only offers assisted living. There are also small board and care homes that care for anywhere from 3-10 people. These are homes that have been converted to a board and care.

Example:

Sara was 87 years old and living in her own home. She was not getting out of the house and not socializing with anybody. Her daughter, Joan, arranged to have her mother move to an Assisted Living Facility after she realized that she was forgetting to take her medications and was not able to handle her own hygiene issues. She didn’t need skilled nursing care, but she did need help with her activities of daily living. Now Joan will not worry as much since there will be caregivers ensuring her mother gets her medications and assistance with her personal hygiene. Her mother will be able to participate in the weekly activities so she will remain active socially.

Adult day care, is a community-based service that was developed to help keep people out of nursing homes and in their homes. Adult day care facilities offer custodial care during the weekdays (some provide weekend service). This care can be provided to people who need minimal assistance and have moderate impairments. Patients with Alzheimer’s or senile dementia are ideal candidates for this program.

Adult day care centers offer a form of support for those who live in their own homes, or even with their children. Adult day care centers offer family members who are providing care the much needed break during the day to continue to live their lives and provide care for their loved ones.

Example:

Lyle lives with his daughter, Sandy. Sandy works full time. Lately, she has noticed that Lyle has been forgetting to prepare and eat his meals during the day. One day she was called at work by a neighbor who found him wandering down the street. Sandy wants to take care of her father after work and on the weekends, but she needs help during the day. An adult day care would provide her with the solution she is looking for.

Contact us to find out more about the types of Long Term Care and how to create a way to pay for it.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

Facilities

There are a number of facility settings where Long Term Care services can be provided. Some of the most common options are discussed below.

Nursing homes or skilled nursing facilities (SNF’s) are residential homes for those who require constant nursing care or have significant deficiencies with Activities of Daily Living (ADL’s). Residents can be any age group as long as they require this type of care. They can be there to receive different kinds of care including physical, occupational, and other rehabilitative therapies.

Types of services provided in nursing homes include services of nurses (or nursing assistants/aides), therapists (speech, occupational, etc.), social workers, etc. Most care in nursing facilities is provided by certified nursing assistants, not by skilled personnel.

Nursing facilities that participate in the Medicare and Medicaid programs are subject to federal requirements regarding staffing and quality of care for residents.

Assisted living Facilities (ALF’s) provide supervision or assistance with ADL’s. They also provide coordination of services by outside health care providers. Their main goal is to monitor resident activities to help to ensure the resident’s health, safety, and well-being. They do this through supervision of medication or personal care services provided by a trained staff person. These facilities are perfect for those who cannot live independently in a private residence, but who do not require the 24-hour care provided in nursing homes. This type of facility is very good for socialization as well since usually meals are served in a dining room.

Board and Care Homes are housing facilities for seniors or those with disabilities who live in a group situation and get assistance with personal care and ADL’s. Generally speaking, a Board and Care facility is the best option when 24-hour, non-medical supervision is needed for a person because of the personalized attention and sometimes small size.

Board and Care homes were the first recognized form of assisted living facilities, and are now regulated by government agencies. However, many are the smaller “mom and pop” type places and run without licenses. If someone is considering this type of care facility, licensure status should be confirmed with the appropriate licensing office. Board and Care homes can be up to 6 residents in a typical single family home, or may be a large building similar to an apartment building with over 100 residents. Meals are usually provided no matter how many residents live there.

Please contact us to talk about how you can have more choices for your Long Term Care if you should need it.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

LTC Frequently Asked Questions

LTC Insurance Frequently Asked Questions

Q: What is Long Term Care?

A: Long Term Care is a variety of services that includes medical and non-medical care for people who have a chronic illness or disability. Long Term Care helps meet health or personal needs. Most Long Term Care is to assist people with support services such as Activities of Daily Living (ADL’s) like dressing, bathing, and using the bathroom.

Q: Where do people receive Long Term Care?

A: Long Term Care can be provided in many different settings. Most types of care are provided at the home of the person receiving care or in a community setting such as an adult day care center. Once someone is unable to receive care at home anymore, they might move to an assisted living home, an Alzheimer’s facility or a skilled nursing home.

Q: Who needs Long Term Care?

A: If you are under 65, there is a chance you will need Long Term Care. Forty percent of the 12 million Americans receiving Long Term Care are between the ages of 18 and 64. For those over 65, the likelihood that you will need some type of custodial care rises to 60%. It is estimated that people over 65 face a 40% lifetime risk of eventually needing skilled nursing home care of some duration.

Source: National Clearinghouse for Long Term Care.

Q: How much does Long Term Care cost?

A: The average cost for Long Term Care varies depending on the type of care and the geographical area. The national average for a private room in a nursing home is $74,460. For a home health aide, the average cost is $19 per hour.

Source: John Hancock, Cost Of Care Survey.

Q: Who pays for Long Term Care services?

A: You do. Health insurance, Medicare and Medicare supplements do not pay for Long Term Care services. They are designed to pay for short-term skilled rehabilitation services only. Many people think their disability insurance pays but disability insurance provides income replacement only. It will not actually cover any cost of care.

Q: Will Medicare cover my LongTerm Care?

A: Medicare and Medicare Supplemental plans cover Long Term Care to a limited extent. They only pay for skilled medical rehabilitation in a nursing home over a limited period of time, typically three weeks to a month, after a hospital stay. They do not cover custodial or intermediate care in nursing facilities.

Q: Will Medicaid cover Long Term Care?

A: Medicaid is a state/federal welfare program that provides benefits covering nursing home care and limited home care only after you have spent down (depleted) the specified amount of your personal assets. To qualify for Medicaid, you must have:

•Depleted most of your assets

•Directed most of your income toward your care and;

•Require nursing home level services

Q: Who is Long Term Care insurance for?

A: All adults should consider purchasing Long Term Care insurance. The need for Long Term Care services can happen anytime due to an illness or accident. As we age, the risk becomes higher that we will need this type of care. The younger you are, the less expensive it will be, and the better chance of qualifying you will have.

Q: What exactly does Long Term Care insurance cover?

A: It all depends on the type of plan you choose to purchase, but Long Term Care insurance covers skilled and custodial services in a variety of settings, including in-home skilled and custodial care, adult day care, assisted living facilities, nursing home care and Alzheimer’s centers.

Q: How do I qualify for Long Term Care insurance?

A: Long Term Care insurance is underwritten according to your medical history and current health status. When you apply, you must also be able to perform all of your (ADL’s including bathing, dressing, eating, toileting and transferring.

Q: If I move, will my policy move with me?

A: Yes, most policies have what is called “portability,” which means they can be used anywhere within the U.S. Some carriers have policies that will even cover benefits outside of the U.S.

Please contact us with your questions about Long Term Care!

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

LTC Mistakes

Mistakes To Avoid When Considering Long Term Care

Thinking about your Long Term Care planning can be overwhelming but there are a few things that might help. Trying to avoid the mistakes many people tend to make will help things feel a lot less complicated!

1. The “it won’t happen to me” or “I still have plenty of time” attitude!

No one wants to believe or expect they may need LongTerm Care in the future, no matter how far away. But, the risk is a reality. The only time that’s too late to consider LongTerm Care protection is once you need it. Don’t wait until that time to decide to plan for your future.

2. Believing someone else will pay for your Long Term Care.

Government programs generally do not pay for Long Term Care, and the ones that do, pay a very limited amount. So, it is YOUR responsibility to plan and protect yourself.

3. Buying Long Term Care insurance from an uneducated agent.

This is a big purchase, so you want someone who knows the ins and outs to guide you through the process. Find someone who is knowledgeable in the field, can shop around to get you the best coverage for the best price, and who can explain everything to you along the way.

If you want to avoid the common mistakes of Long Term Care planning, please contact us so we can help you. After all, if you are even thinking about it, you are on the right track. Let us help keep you there!

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

LTCi Premiums

How To Save Money On Long Term Care

Insurance Premiums

The typical response from those considering Long Term Care insurance is that it’s “too expensive.” Although Long Term Care insurance policies usually cost between $1,000 and $3,000 per year, having to pay for care out of pocket is more costly!

There are a few ways you can save on Long Term Care insurance premiums without sacrificing too much.

1. Buy Young

Because premiums are age based, the younger you are, the less they will be. It’s that simple!

2. Look for Discounts

Many different types of discounts apply to Long Term Care insurance policies, which can help you save a lot on premiums if you qualify.

•Spousal or family discounts

•Preferred discounts

•Group discounts

•Employer discounts

3. Consider Co-Insurance

If you choose to co-insure part of the cost of your Long Term Care, you can significantly reduce your premiums. For example, if you lower your daily benefit by 30% and pay the rest out of pocket, you will be able to reduce your annual premium by that same amount.

4. Pay Premiums Annually

You can save approximately 8% a year by making an annual lump sum payment each year on your policy’s anniversary date. The carrier will send you a reminder each year so you don’t forget!

If you would like to learn more about how to save premiums on your long-term care insurance, please contact us.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

LTCi Cost

The Cost of LTC Insurance

Long Term Care insurance premiums are based on your age at the time you apply for coverage, so the younger you are, the less premium you will pay.

There are other factors that affect premium as well and some of the factors vary by company, so always check with an agent that specializes in Long Term Care insurance.

Other Factors That Affect LTCi Premiums:

•Your health at the time you apply

•The length of your benefit period

•The policy’s features, benefits and options

•Discounts you may be eligible for

•Carrier you choose

It is important to point out that despite Long Term Care insurance seeming expensive, the alternative (having no Long Term Care insurance) is much more costly! Considering the cost of Long Term Care today - a single year of needing care would have paid for many years of long-term care insurance premiums!

Contact us to find out how affordable your own LTC policy would be!

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

-

Qualifying

Qualifying For Long Term Care Insurance

The state of your health is the most important factor in determining if you can qualify for long-term care insurance.

How Will Your Health Affect Your Insurability?

Long Term Care insurance companies underwrite their coverage, which means they will look at your health and health history before they make a decision if they will issue your policy and at what premium rate.

If you're in great health, don't use tobacco products and don’t take any medications, then carriers will be quick to accept you because you will be a minimal risk for them. However, certain health conditions could prevent you from qualifying for Long Term Care insurance. Each carrier sets their own health qualifications and they change with time.

LTC Insurance Approval Process

In most cases you do not need to take a physical to apply for Long Term Care coverage. Your eligibility is based on your answers to the application questions, a review of your medical records (if requested) and, in some cases, a face-to-face assessment, or telephone interview with a nurse.

The approval process typically takes four to six weeks. By law, every policy comes with a 30-day right to review, or “buyer’s remorse” clause. If you change your mind, you can receive a complete refund by simply returning your policy during the free-look period.

You have nothing to lose by applying to see if you qualify.

Contact us to find out if you qualify for Long Term Care insurance. There is absolutely no obligation!

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

Employers LTCi

Employers

When one of your employees needs Long Term Care, or must provide Long Term Care for someone at home, it may put your business at risk because it can have a great impact on your bottom line. You may not notice the cost immediately, but over time it may really add up.

If an employee is providing care for someone at home it is almost as if they have another full-time job. It may affect your business in the following ways:

•Decline in productivity

•Decreased willingness to relocate or travel for work

•Not able to work full-time or must resign

•Motivation and morale are compromised

•Interruptions during the day to handle phone calls or emergencies

•Being absent more often

•Increased stress which could result in health-related problems and further absence from work

•Replacement costs if/when employee needs to finally resign

Long Term Care insurance may be one of the newest and fastest growing employee benefits. There are tax incentives to employers for purchasing Long Term Care insurance on behalf of their employees. Employers can pay for all the coverage, part of the coverage, or have employees pay all the cost. Typically employers are willing to fund part of the plan and then allow the employees to purchase additional coverage.

The following will give you an idea of why it might be smart for you to consider this for your company.

Tax Benefits For Employers

Recent healthcare legislation makes qualified LTC insurance policies more tax advantageous for both employers and employees. Employers that pay for Long Term Care insurance may be eligible for favorable tax treatment. However, the exact tax consequences vary depending on the structure of the business (example: sole proprietor, partnership, LLC, C-Corporation, etc.).

•Employer-paid LTC premiums for employee, spouse, and retiree coverage may be deducted as a business expense

•Employers can cover defined classes of workers, making it possible to offer the benefit to only higher-paid employees, such as an executive carve-out

•Employees with medical and dental expenses exceeding 7.5% of adjusted gross income may be able to also deduct eligible LTC premiums they pay

•Premiums are not classified as taxable income to employees

•Benefits are not considered taxable income to the insureds and their families (even if the employer paid the premium)

•Benefits are 100% tax-free to the employees whether the employee or the employer pays the premium

•Premiums currently cannot be included in a Section 125 "cafeteria" plan

Advantages For Employees

When an employer offers long-term care insurance to their employees it helps provide the following benefits:

•Financial security, responsibility and freedom

•Preserve retirement accounts and savings

•Ability to keep job

•Employer-paid premiums not taxable as income

•Employee-paid premiums may be deductible as a medical expense

•Long-term care benefits are not taxable

•The coverage is fully portable

•Ability to receive high quality care for themselves and their families

Contact us to learn how to protect your business from the cost of Long Term Care.

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

LTCi Discounts

Discounts

What Premium Discounts Are Available?

Long Term Care insurance companies are able to offer several choices of premium discounts for couples and partners, and even extend these discounts to people living in the same house such as siblings when they both apply for coverage. In addition to those types of discounts, incentives are given for preferred health, families, loyalty, association and worksite.

Most Long Term Care insurance companies offer married or couple discounts to gay and lesbian couples that live together, even if they are not married. The typical Long Term Care insurance couple and partner discounts can range from 10% to as much as 50% depending on the specific company.

Preferred or good health discounts are given to Long Term Care insurance policy holders who have above average health. These preferred health discounts could be significant, ranging from 10-20% off the entire Long Term Care insurance premium. Each Long Term Care insurance company may have different preferred health criteria, which an applicant must meet in order to qualify.

Family discount means when the insured and at least two other family members own separate individual Long Term Care insurance policies. Each can receive a discount of about 5%. Not all carriers offer this discount.

An insurance company may offer loyalty discounts to their current policyholders (if they have their homeowner’s insurance with that company, for example) as an added benefit because the insured has done business with them before. These discounts can begin at 5%.

You can save 5% to 10% if you are an active member of an association group. These policies are generally called “multi-life” and are offered to the entire membership in the organization.

Many carriers offer a 5% to 10% discount if the insurance plan is offered at your place of work with payroll deduction for ease of premium payments. The plans are called “true group” and cover many employees and family members.

The way the premiums are paid to the insurance company will also determine if there is a discount for the payments made on an annual basis as opposed to monthly, quarterly, or semi-annual. One annual premium paid is the lowest cost for administration.

The premium savings on your Long Term Care insurance policy can be very significant so call us to find out what discounts you qualify for!

This web site may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting or tax advice. You may wish to consult a competent attorney, tax advisor, or accountant. PLEASE NOTE: If there are links on this page they are provided strictly as a courtesy and the pages referenced are maintained by external sources. There is not guaranteed as to the accuracy of the information contained in the web sites you are linking to.

Copyright © 2009

-

Age to Buy LTCi

When To Buy Long Term Care Insurance

Think about people you know who have been in good health until a major accident or the sudden onset of an illness caused them to require substantial assistance from another person. These can include boating or auto accidents, sports accidents such as a fall during skiing, onset of Multiple Sclerosis, Parkinson’s, a stroke or various other conditions.

All of these could cause a person to need long term care. With the medical advances today people are living longer lives but sometimes with chronic health problems. The sooner you buy insurance, the better, because once you need it, it’s too late!

Three Important Reasons Not To Wait

1.The longer you wait, the greater your chances of becoming uninsurable due to an illness or other condition. Your eligibility is based on your physical health and mental acuity at the time of application, which generally speaking, is better when you are younger.

2.Your long term care insurance premiums are based on your age at the time of application. The sooner you apply, the easier it will be to get coverage and the less expensive it will be.

3.Once you're approved, your rate does not increase as you age or if your health deteriorates. An insurance company may increase premiums on an entire class basis - not just for your policy.

Copyright © 2009

Marty Puin & Associates Inc.

5001 Mayfield Rd. #126

Lyndhurst, Ohio 44124

(216)-381-8039 office

(216)-381-8059 fax